💰 Need a Fast Loan in Australia? Your Guide to the Best Loan Options

When life throws you a curveball — a sudden medical bill, urgent car repairs, or rent due tomorrow — it’s natural to start thinking:

👉 “Where can I get a fast loan in Australia?”

But speed isn’t the only factor. You also need a loan that’s safe, transparent, and suited to your financial situation. 🛡️

Between banks, online lenders, credit unions, and payday providers, the range of loan options in Australia can feel overwhelming — and risky if you don’t know what to look for. 😓

💡 Why It’s Not Just About “Getting Approved”

In a moment of stress, it’s tempting to grab the first fast loan ad you see that says “instant approval” or “no credit check.” But not all loans are created equal — and not all promises are realistic or in your best interest. ⚠️

What you actually need is the right type of loan for your needs, something that matches:

- 🏦 Credit profile

- 📅 Repayment capacity

- 💵 Amount required

- ⚡️ Timeframe to access the funds

This guide will help you navigate the different loan options in Australia so you can make a quick but smart choice. ✅

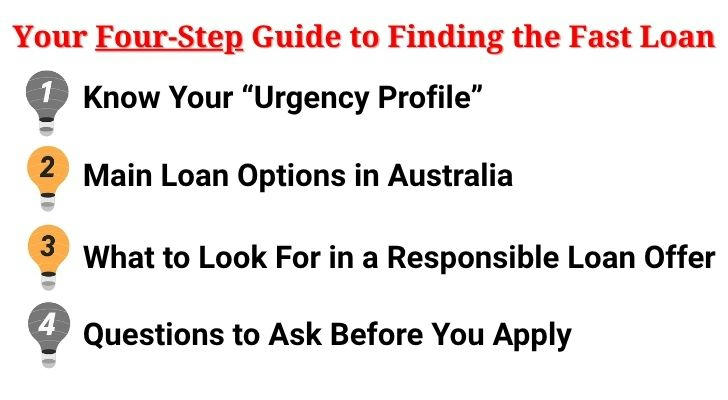

🔍 Step-by-Step: How to Find the Right Loan in Australia

🧠 Step 1: Know Your “Urgency Profile”

Ask yourself:

- ⏱️ Do I need the money today, or is 2–3 business days acceptable?

- 🧾 Is this a one-off emergency, or do I need ongoing access to funds?

- 💸 How confident am I about repaying on time?

👉 If you need funds within hours and have irregular income, your solution will be very different from someone consolidating debt over 12 months.

🏦 Step 2: Know the Main Loan Options in Australia

| Lender Type | Best For | Watch Out For | Where to Start |

|---|---|---|---|

| 💻 Online Loan Platforms | Comparing fast short-term options | Higher rates or fees for low-credit applicants | Finder, Canstar, Compare the Market |

| 🏛️ Credit Unions | Lower rates for members | Slower approvals; membership requirements | Credit Union Australia (CUA), People's Choice Credit Union |

| ⚠️ Payday Lenders | Same-day funding, low credit barriers | Very high fees, short repayment terms, debt cycle risk | Use only licensed lenders via ASIC |

| 📆 Installment Loan Providers | Flexible repayment over months/years | May require good credit or stable income | SocietyOne, MoneyMe |

| 📱 App-based / P2P Lenders | Tech-savvy borrowers, gig workers | Less regulation, variable experiences | Plenti, Wisr |

🔎 Step 3: What to Look For in a Responsible Loan Offer

To avoid financial stress later, always check:

💲 Total Repayment Cost → Look beyond monthly payments — check the total amount you’ll repay.

📊 APR vs. Interest Rate → APR gives the real yearly cost, not just the base rate.

🕒 Late Payment Policies → Know the penalties or whether flexible arrangements exist.

✅ Early Repayment Options → If you can repay early without penalties, you could save a lot.

💰 Loan Repayment Calculator (AUD)

❓ Step 4: Questions to Ask Before You Apply

Before clicking “Submit,” ask yourself: 🤔

- ❗ Do I really need this fast loan now, or is there an alternative?

- 🔍 Have I compared at least 2–3 loan options?

- 📉 Will the repayments fit comfortably in my budget?

- 📄 Is the lender licensed with ASIC?

A few minutes of research now can save months of stress later. ⏳

👤 Real Example: Choosing the Right Fit

Amelia, a hospitality worker in Sydney, needed $1,500 AUD to cover rent and bills after her hours were cut. She considered a payday lender but realised the 14-day repayment term would leave her in a worse position. 😰

Instead, she used Finder to compare short-term loan options. She found a personal loan with:

- A 6-month repayment plan 📅

- A lower APR 📉

- Approval based on her part-time income 💼

Funds landed in her account the next business day — without the debt trap. 💪

✅ Final Thoughts: Choose Clarity, Not Panic

Emergencies happen, but that doesn’t mean you should rush into risky debt. 🚦

With the right research, you can:

- 💡 Find a fast loan that fits your situation

- 🧭 Avoid high-cost traps

- 💼 Stay financially stable — even in a crisis

So whether it’s $500 for a dental bill or $3,000 for urgent repairs, take a moment to compare your loan options in Australia and choose the one that protects your future — not just your present. 💚