💰 Need Cash Fast in Canada? Here’s How to Find the Right Loan Option for You

When unexpected expenses strike — a medical bill, a broken car, or rent due tomorrow — many people find themselves asking the same urgent question:

👉 “Where can I get a loan fast?”

But speed isn’t the only factor that matters. You also want a loan that’s safe, transparent, and tailored to your financial situation. 🛡️

That’s where many people get stuck. Between payday lenders, online platforms, credit unions, and personal loan providers, the options can feel overwhelming — and risky if you don’t know what to look for. 😓

💡 It’s Not Just About “Getting Approved”

In a moment of stress, it’s tempting to choose the first loan that says “instant approval” or “no credit check.” But not all loans are created equal — and not all promises are realistic or in your best interest. ⚠️

What you really need is the right kind of loan for your specific needs — something that matches your:

- 🏦 Credit profile

- 📅 Repayment capacity

- 💵 Amount required

- ⚡️ Timeline for accessing the funds

This guide will help you navigate your options and make an informed, confident choice — quickly but wisely. ✅

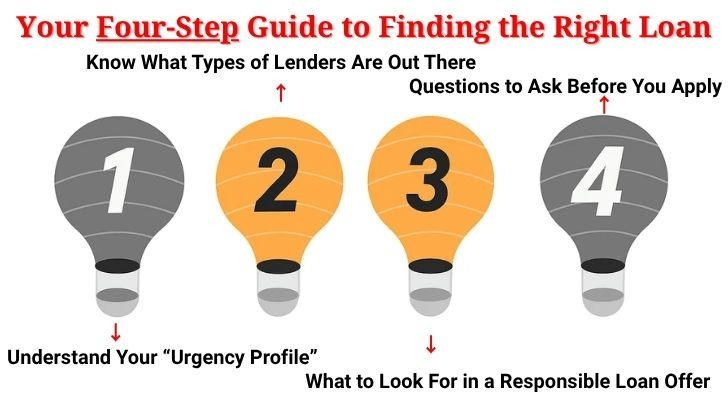

🔍 Step-by-Step: How to Find the Right Loan for Your Situation

🧠 Step 1: Understand Your “Urgency Profile”

Ask yourself:

- ⏱️ Do I need the money today, or is 2–3 business days acceptable?

- 🧾 Is this a one-time emergency, or do I need ongoing access to funds?

- 💸 How confident am I in my ability to repay on time?

👉 If you need funds within hours and have irregular income, you’ll need a different solution than someone looking to consolidate debt over 12 months.

🏦 Step 2: Know What Types of Lenders Are Out There

| Lender Type | Best For | Watch Out For | Where to Start |

|---|---|---|---|

| 💻 Online Loan Platforms | Comparing fast short-term options | Some may have higher interest or service fees | Loans Canada, Borrowell |

| 🏛️ Credit Unions | Lower rates for members | Slower processing; may require good standing | Desjardins, Coast Capital |

| ⚠️ Payday Lenders | Instant approval & low credit barriers | Very high fees, short terms, risk of debt cycle | Only licensed lenders via provincial regulators |

| 📆 Installment Loan Providers | Flexible repayment over time | May require stronger credit or steady income | Fairstone, Mogo |

| 📱 App-based / P2P Lenders | Younger users, gig economy earners | Less regulation, inconsistent experience | GoPeer, Lending Loop |

🔎 Step 3: What to Look For in a Responsible Loan Offer

To avoid future headaches, here are 4 things you should always confirm:

💲 Total Repayment Cost → Don’t just look at the monthly payment — check the total you’ll repay, including fees and interest.

📊 APR vs. Interest Rate → APR (Annual Percentage Rate) is a clearer picture of true cost — not just the surface rate.

🕒 Late Payment Policies → What happens if you’re a day late? Are there penalties or flexible terms?

✅ Early Repayment Options → Can you pay it off early without fees? This can save you money in the long run.

💰 Loan Repayment Calculator

❓ Step 4: Questions to Ask Before You Apply

Before hitting “Submit,” take a moment to reflect: 🤔

- ❗ Do I truly need this loan now, or do I have alternatives?

- 🔍 Have I compared at least 2–3 lenders or platforms?

- 📉 Will the repayment schedule realistically fit my monthly budget?

- 📄 Is this lender licensed in my province? (Check on your provincial government or consumer affairs website.)

A few minutes of research now can save months of stress later. ⏳

👤 Real Example: Choosing the Right Fit

Amira, a university student in Toronto, needed $1,000 to cover rent and groceries after losing her part-time income. She considered a payday loan — but realized the 14-day repayment would leave her deeper in debt. 😰

Instead, she used Loans Canada to compare short-term installment options. She found a lender offering:

- A 3-month repayment plan 📅

- A lower APR 📉

- Approval based on her part-time job income 💼

The funds arrived the next day — and she stayed in control of her finances. 💪

✅ Final Thoughts: Choose Clarity, Not Panic

Emergencies don’t wait — but that doesn’t mean you have to make rushed or risky decisions. 🚦

With the right tools and questions, you can:

- 💡 Find a loan that fits your situation

- 🧭 Avoid high-risk traps

- 💼 Stay financially stable — even when life throws a curveball

So whether you need $500 for a dental bill or $2,000 for urgent repairs, take a breath, compare your options, and choose a lender that earns your trust — not just your urgency. 💚